We, at Viromii. have asked this question to many actors within the european startup ecosystem, and found interesting insights that are worth sharing with you. Performance parameters are usually variable depending on the industry or type of venture, however, there are always a set of underlying invariable parameters that will indicate better or worse performance.

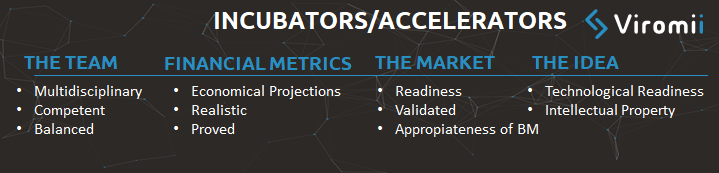

According to a set of six international incubators and accelerators from different countries, the key venture performance parameters were the following:

As we can see, incubators and venture accelerators had a very holistic approach towards venture analysis. From here, it can be highlighted the part of financial metrics, where these institutions wanted an actual economic proof that the business was reliable. This can be due to the fact that incubators and accelerators usually invest to a certain extent in their hosted companies, looking for a ROI and also for a high survival and success ratio that will be good publicity for their business, and increase their reputation.

If we ask the same question to startups, we see many similarities but small changes in the perception of what is important for them. In the team, for example, what they value the most is the relations between the team itself and if they are qualified for the job at the startup. This is rather understandable, as they are the ones that have to deal with the team on an everyday basis. In what incubators and accelerators perceive as the idea, startups perceive their competitive advantage, and here is where the founders add the network.The market side is, on the other hand, very straightforward and similar for both actors. Furthermore, something interesting is how startups separate the situation as the timing for setting up the company and location where you set up the firm, from the market, which, in our opinion are very related.

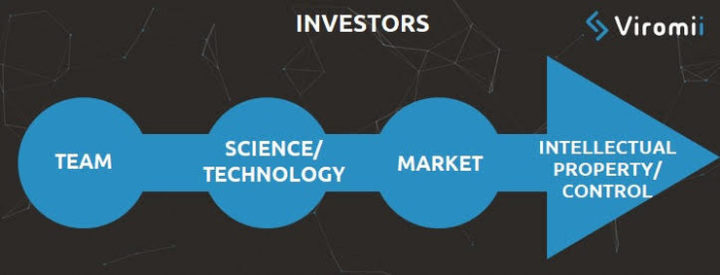

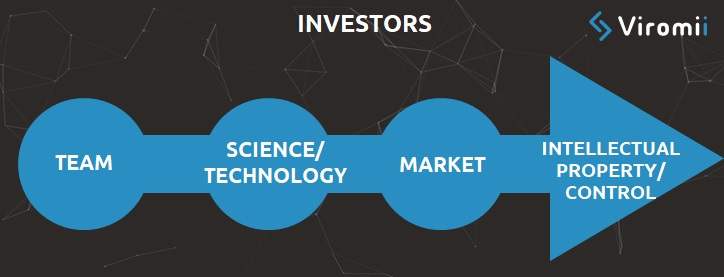

According to investors, they did not separated these factors as the other actors did, but ranked them in a more piramidal way. In this system, the basis would be built by a capable team flexible enough to accept structural and organizational changes. That team should come with a robust idea built over a strong technological basis. If these two parameters are on place, then the market should be validated, scouted, and ready for the acceptance of this technology. Finally, after having all these variables settled, it comes the intellectual property to correctly control the capitalization and secure the position of the innovation in the market.

In conclusion, although there exist similarities between start-ups, incubators, and investors, in how they analyze and understand venture performance parameters, the perception is what varies. From this, we can extract that these performance parameters are heavily reliant on the business model of each specific actor, where for a start-up is usually financial and market growth, while for an incubator might be survival ratio and publicity, and for an investor looks to be how sound is the business in a more holistic perspective.