In the previous post we could see the greatly negative impact that losing market exclusivity has over the financials of pharmaceutical companies, specially when it was about a blockbuster drug. This leads us to think, what can pharma companies do to placate such sales impact? Well, there exist a number of strategies these companies can implement to minimize the harm of losing the exclusivity of one of their drugs. In this post we will go over them, so check it out.

Pharma companies usually file patent applications for their drugs as early as possible, mainly because they know that it is common for other companies to be conducting research in similar indication areas and drugs. However, this approach has the risk of expiring the patent way before optimal, as drug development is a very slow practice taking on average 12-13 years to complete research, development and achieving regulatory approval, and leaving just 7-8 years for proper commercial exploitation with exclusive patent rights. This, usually leads to insufficient time to achieve a positive revenue on the investment made for the R&D of the drug.

There are four main strategies that pharma companies usually implement to aplacate the “patent cliff” (loss of exclusivity leading to a drop in the revenues from a certain drug), which include preventive, innovation, extraction and adaptation strategies. In this post we will focus on preventive strategies.

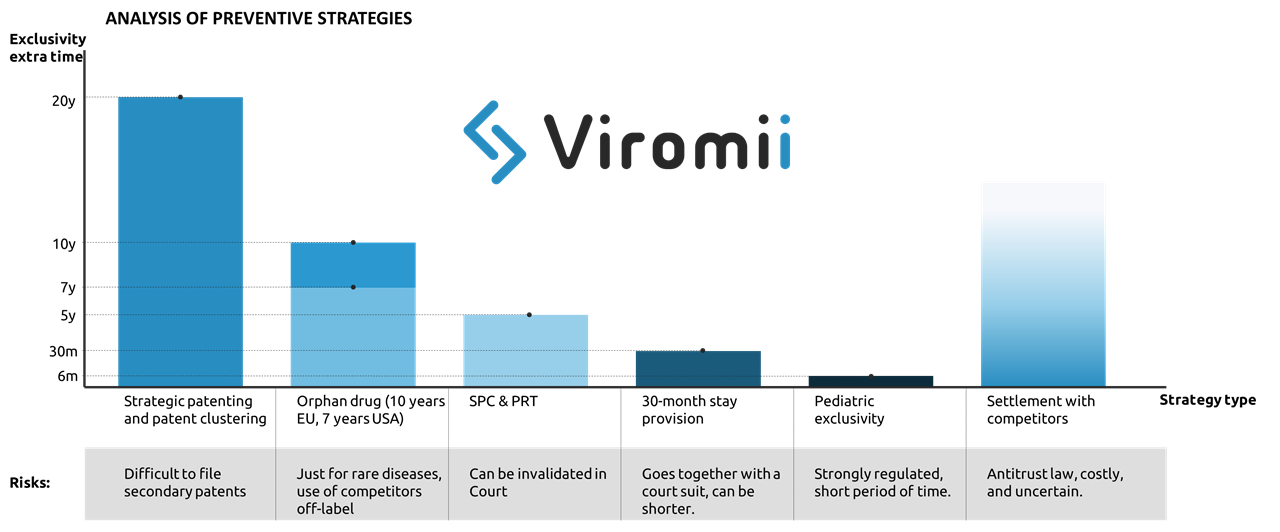

Preventive strategy basically implies the exploitation of possibilities for extension of market exclusivity mostly by means of legal measures. Examples of this are:

- Strategic patenting: where the company files multiple patents to provide with longer time of protection of core parts of the drug surrounding the base patent. This practice is named patent clustering. Acquisition of secondary patents apart from the main active drug compound or ingredient. For example filling for crystalline forms derived from the original compound, methods of administration, formulations, etc. This is also applicable for patents in the manufacturing process, where the protection of some purification or process optimisation can be possible at later stages of product lifecycle, hence either complicating or simply extending the product exclusivity life. Incremental improvements to the primary patent in form of secondary patents might provide with extended exclusivity for the drug in the market. One example of this strategy in use is Ritonavir (for HIV) which created a great cluster of secondary patents granting up to 12 years of extra protection to their drug against generic products. The ratio of primary to secondary patents is 1 primary to 7 secondary patents. Though this practice might be sometimes successful stopping generic entry, stricter patentability standards are making the patent cluster strategy more and more vulnerable.

- Another preventive strategy to deter generic entry is to apply for market exclusivity extensions through supplementary protection certificates (SPC). SPCs are additional protective mechanisms that work as an extension of the patent right. In EU, SPCs are usually issued to compensate R&D costs and the usually too long period between the patent filing and the market authorization. This certificates can extend up to 5 years the products after the expiration of the patent. However, same as with patents, SPC extensions can be legally challenged and invalidated. The analogous in the US and Japan are the PTR (Patent Term Restoration) which grants with additional 5 years of protection upon patent expiration.

- In the US, there also exist a legal option to get 30 additional months of exclusivity by filing a patent infringement suit against an ANDA(abbreviated new drug application, which usually applies for generic drugs). The 30-month stay is applied when a patent infringement action is initiated and the patent information was submitted to the FDA before the generic drug application was submitted.

- Getting orphan drug status can extend up to 7 years your exclusivity in the US, and 10 in the EU. However, this designation will just be issued for drugs that target rare diseases, which must be life-threatening or chronically debilitating, and cannot affect more than 5 patients in 10.000, not existing other adequate treatment. Other advantages of this status are fast-track approval and tax credit. This strategy has been implemented by a number of pharmaceutical companies, being Shire Plc (now part of Takeda) one of the most well known examples of company strongly focused on development of drugs focused on rare diseases.

- Similar to orphan drug status, application for pediatric clinical trials on the FDA might grant up to 6 months of extended protection.

- Finally, if generic entrants challenge the validity of the patents held by the innovative company, they might reach an out-of-court settlement which can include a substantial payment (covering their potential sales in case the generic would have made it to the market). The main risk of this practice is competition law, as the OECD can issue considerably high fines for infractors.

In the following posts we will explore the next strategies. We hope you enjoyed the read and learned something new. Follow us to know more!

Sources: